- Mobius Market Research

- Topics

- Energy Shots

ES #148: $750 billion in US energy

The U.S. and EU struck a trade deal on Sunday afternoon that, according to a joint press conference between President Trump and European Commission President Ursula von der Leyen, includes a 15% tariff on nearly all EU goods (excl. metals and pharmaceuticals), a $600 billion increase in EU investments into the US, and an EU commitment to purchase $750 billion of U.S. energy exports.

ES #141: Fed Spreads & Recession

The spread between the effective federal funds rate and the market yield on U.S. 2YR Treasuries is currently at the 86th percentile of its 1999-2025 historical distribution as the Fed's 168-day pause since its last rate cut indicates increasing downside risks from politicization

ES #140: Record U.S. Production, Fading Growth

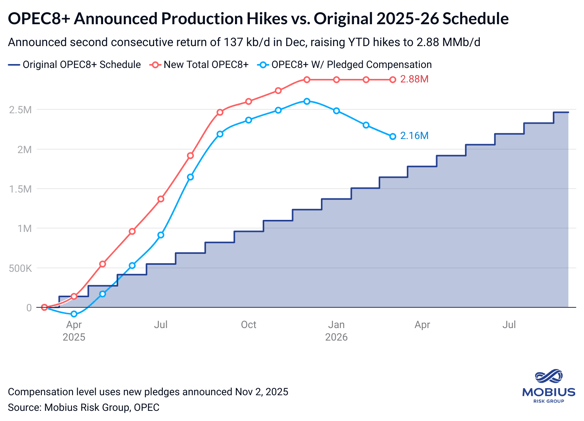

A closer look at underlying trends in the EIA’s delayed monthly data reveals signs of diminished growth potential that precede 1) WTI’s recent retreat to $60 (Mar ‘25 WTI settled at $72.57 and Apr ‘25 WTI settled at $68.28) and 2) the latest additions to OPEC’s accelerated production schedule.