- Mobius Market Research

- Posts

- Third-Term Maduro

Third-Term Maduro

As expected, Sunday's Venezuelan election welcomes plenty of questions. Eyes turn to November.

Maduro v. November

Thursday’s Mobius Intel Brief (subscription required) highlighted three scenarios for Venezuelan crude after this weekend’s presidential election between Nicholas Maduro (Ruling Party) and Edmundo Gonzalez (Opposition Party).

With each scenario posing unique risks to Venezuela’s:

World-leading oil reserves (303 billion barrels)

Eighth-largest proved gas reserves (222 trillion cubic feet)

700 kbpd+ crude and condensate exports

According to early reports, the opposition party appeared optimistic about a landslide victory over two-term Maduro. The party's unofficial leader, Marina Corina Machado, declared that Gonzalez secured 70% of the vote in early tallies.

The opposition party’s victory proved short-lived, however.

The National Electoral Council (CNE) announced early Monday morning that Maduro won 51% of the vote and a third six-year term in office, overcoming Gonzalez’ 44%. Despite the CNE’s announcement, both parties are claiming victory as of 4:00 a.m. central.

As outlined in our Thursday report, Venezuela’s election outcome poses material consequences for global energy markets, with the most severe near-term supply-side risks evident in our “Maduro victory” scenarios.

As anticipated, the U.S. and other LatAm leaders expressed their skepticism to Maduro’s victory alongside Venezuela’s opposition party, opening the door for 1) intra-Venezuelan conflict risks and 2) more severe sanctions on PDVSA and Venezuelan sovereign debt.

While plenty of changes to Maduro’s victory could unfold in the following days and weeks, we shift our attention to November’s U.S. presidential election and the early signals for energy market stakeholders to monitor — specifically, inflation and its role in past election years.

If Inflation is Top of Mind:

We flag three related trends ahead of an in-depth Energy Shots analysis of commodity market performance and election outcomes, limiting the scope of the following to the upstream levers behind deteriorating consumer and business sentiment:

Overall inflation,

Energy inflation, and

Rent/housing inflation.

As outlined previously, energy inflation warrants closer monitoring as an embedded input cost in all aspects of the U.S. economy.

Historical analysis of consumer price index (CPI) energy — the upside price pressures on consumer spending from energy — reveals relevant trends for this year’s presidential and congressional voting activity.

Elevated consumer spending on energy tends to precede ±1σ standard deviation or greater changes to congressional seat holdings.

Energy inflation spikes, such as those in 2022, tend to negatively affect the House of Representatives majority more than the Senate — though readers should caution against the limited sample size since 1958.

Energy and Shelter Inflation by Administration, 1972+

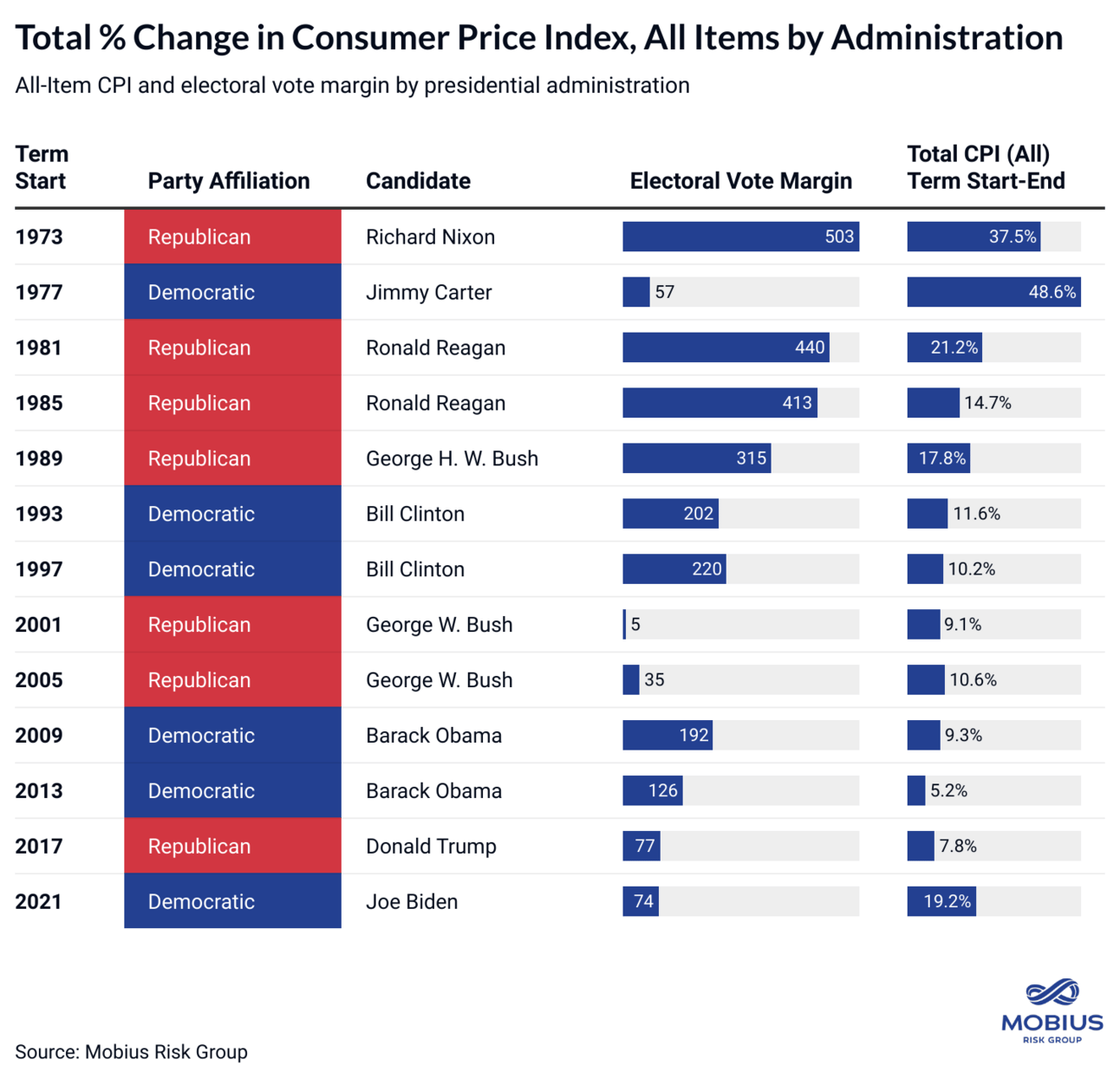

The three tables below outline the percent change in consumer prices from the beginning to the end of presidential administrations. Two-term administrations are separated to delineate disinflationary trends (Reagan, Clinton, Obama) and inflationary trends (Bush).

The electoral vote margin indicates the strength of each candidate’s victory prior to the start of their term — calculated as electoral votes received minus the second-place challenger.

Since 2021, consumer prices on energy have increased by 32%, shelter by 21.9%, and all items (CPI) by 19.2% — collectively ranking inflation under the Biden administration through June 2024 as the highest since President Reagan’s first term post-Carter administration.

What U.S. Inflation Means for Venezuelan Sanctions

Limited wage growth relative to the pace of inflation suggests shifts to 1) congressional majority and/or 2) presidential party affiliation is likely.

With inflation top of mind for voters, Venezuela’s vote this weekend amplifies the near-term consequences of the Biden-Harris administration’s next move.

Escalating sanctions and sanctions enforcement amplifies Q3 supply deficit risks, adding an upside skew to the U.S. energy inflation outlook and a downside skew to election efforts.

Continued reading on Venezuelan crude scenarios (subscription required):

We will continue to provide more election-related analysis through November. Questions or requests for specific coverage can be sent to [email protected].

WWMD: What Would Mobius Do?

Mobius was founded in 2002 by a cadre of risk management and commodity trading experts. We don’t just help you cover your downside exposure from lurking risks. Our analysts and strategy experts also help you identify (and take advantage of) lurking opportunities in global commodity markets.

We serve you, and you alone, as unconflicted allies.

Let us know… Send questions, comments, or requests to [email protected]

Recent Top Reads:

Record Travel v. Deteriorating Manufacturing: July's industrial sector performance, robust travel, and the latest trends in U.S. product consumption.

Rate Cuts v. Chinese Demand: China's 2H24 crude import demand expectations against the follow-on effects of PBOC rate cuts

CoT: Stalling Bulls: A closer look at the latest speculator positioning

Inflation-Adjusted Energy: and the consequences of extensive regulation and domestic resource availability on energy demand

Grain's Record Selling Pressure: and how La Nina could change the picture

2024's Record Air Travel: Record airline passenger traffic makes U.S. jet fuel demand a shining light in otherwise underwhelming product consumption data

Copper's Inflection Point: Questionable forecasts for Chinese import demand, rapid gains in LME/SHFE inventories, a recovery in the Yangshan premium, and bullish expectations for long-term demand.