- Mobius Market Research

- Posts

- G7 Bids Farewell to Coal

G7 Bids Farewell to Coal

G7 energy ministers reportedly reached a deal to shut down coal-fired generation between 2030 and 2035.

Mobius Intel Brief

Group of Seven (G7) Members: Japan, Germany, United States, United Kingdom, Canada, France, Italy

G7 energy ministers reportedly reached an agreement to phase out coal-fired power generation

When: Finalized deal expected 04.30.24 for phase out between 2030 and 2035

Takeaways: Germany, Japan, and the United States have the highest share of coal-fired generation in the G7. While the United States benefits from abundant domestic alternatives like natural gas, Germany and Japan must replace coal-fired power with a scalable, reliable, and affordable import. Ministers are expected to announce incentives for battery storage to offset renewable intermittency. Still, stakeholders should note that Europe’s generation resources have yet to be tested by a cold winter in the post-Russia sanctions era. How the G7 agreement will affect Japan’s coal and ammonia co-firing plans remains unclear. Ultimately, early retirements of coal-fired capacity support U.S. LNG exports to G7 allies.

Read Time: 3 min.

G7 Bids Farewell to Coal

According to Reuters sources, G7 energy ministers agreed to shut down coal-fired power generation between 2030 and 2035, with a final deal due tomorrow.

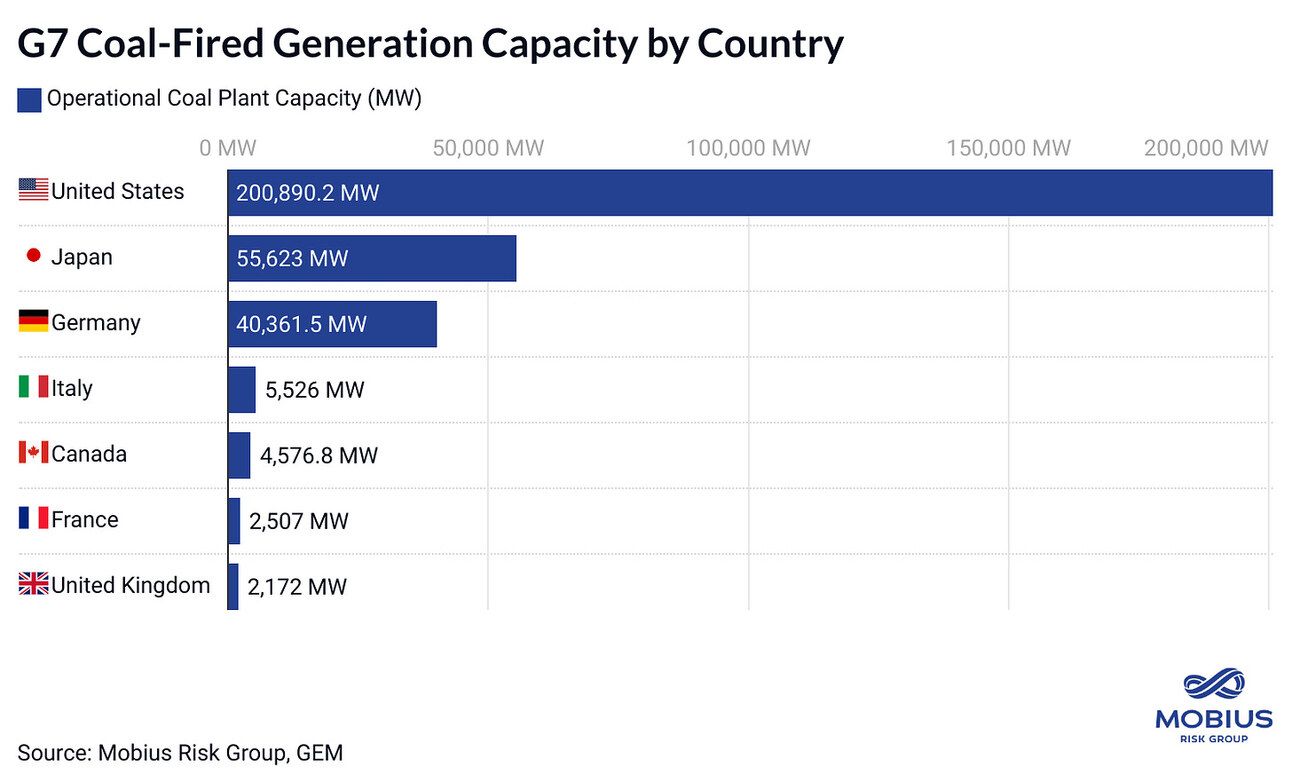

If confirmed, early retirements of coal-fired power plants will have the most significant impact on Germany, Japan, and the United States.

While the U.S. maintains almost four times as much operational coal-fired generation capacity as second-ranked Japan and five times as much as third-ranked Germany, the latter countries rely on coal for over 50% more power generation in their overall resource mix than the United States.

Under conditions of low load growth, such as those observed over the previous two decades in G7 economies, early coal plant retirements would pose a modest risk of supply shocks.

However, with massive electrification needs on the horizon, the G7 agreement will require concomitant investments in flexible generation to balance renewable intermittency. Over-indexing the G7 resource mix to wind, solar, and battery storage will welcome extreme energy price volatility with consecutive days of constrained wind and solar output.

The Bullish and Bearish

Europe

European energy security has yet to be tested in the post-Russia sanctions era, as back-to-back mild winters have eased pressure on the bloc’s natural gas supply chain.

Last week, EU sources told Reuters that the next sanctions package out of the European Commission would include proposed restrictions on Russian LNG. While unlikely to include an outright ban on Russian LNG imports into the EU, the proposal will likely impose sanctions on Russian LNG infrastructure projects and invite a response from Moscow.

As Europe reduces diversification in its generation mix, the bloc will increase price pressures on an already struggling industrial sector, which is bearish for the region’s economic growth outlook. Price instability will invite more industrial outflows to areas with more robust energy security.

United States

Meanwhile, the G7-wide agreement creates notable bullish support for U.S. LNG exports, contingent on American energy policy eliminating uncertainty for allied buyers.

Australia and Indonesia

Coal exporters Australia and Indonesia will lose approximately a third of their existing import demand, though expanding coal-fired generation capacity across Asian emerging markets could offset losses from Japan, the EU, and the UK.

What About Japan’s Ammonia Goals?

Japan’s proximity to coal-rich Asian regions supports coal-fired generation for strategic energy security, hence its reluctance to pass a concrete timeline for phasing out coal when it held the G7 presidency last year.

Instead, the country outlined plans to co-fire ammonia with coal to reduce carbon intensity, with Japanese utility JERA expanding its testing phase earlier this year.

It remains unclear how the G7 agreement will affect Japan’s generation plans. A shift away from ammonia co-firing could affect policies for neighboring Asian markets like India, which has stated its intentions to use ammonia alongside its expanding coal-fired power fleet.

WWMD: What Would Mobius Do?

Expertise and perspective for commodity-impacted businesses

Curious about Mobius' integrated financial and physical strategic support solutions for commodity and energy-impacted businesses?

Recent Top Reads:

Where Power Goes Negative: Tracking the repercussions of misaligned generation incentives and the localized opportunities for energy industry stakeholders

Delinquencies, Charge-Offs, and Inflation: Pressure on the 'resilient consumer' meets high Core PCE inflation that isn't as isolated from energy prices as the Fed suggests.

The Other Winners of Electrification: The mounting electricity needs from AI, EVs, batteries, and transmission infrastructure bolster the outlook for these commodities.

The Real Power Required for EVs: Letting math guide the EV conversation.

Four Pressures for U.S. Refined Products: U.S. refinery margins face four simultaneous downside pressures

Structural Shortcomings in a Volatile Demand Landscape: How underinvestment, policy hurdles, and two new dimensions of volatile demand destruction are complicating the path to profitability for the U.S. natural gas industry