- Mobius Market Research

- Posts

- ES #150: OPEC8+ Hike... Then Pause

ES #150: OPEC8+ Hike... Then Pause

The eight members of the OPEC+ voluntary cut crew (OPEC8+) announced their ninth consecutive hike on Sunday, but there's a twist...

Energy Shots #150

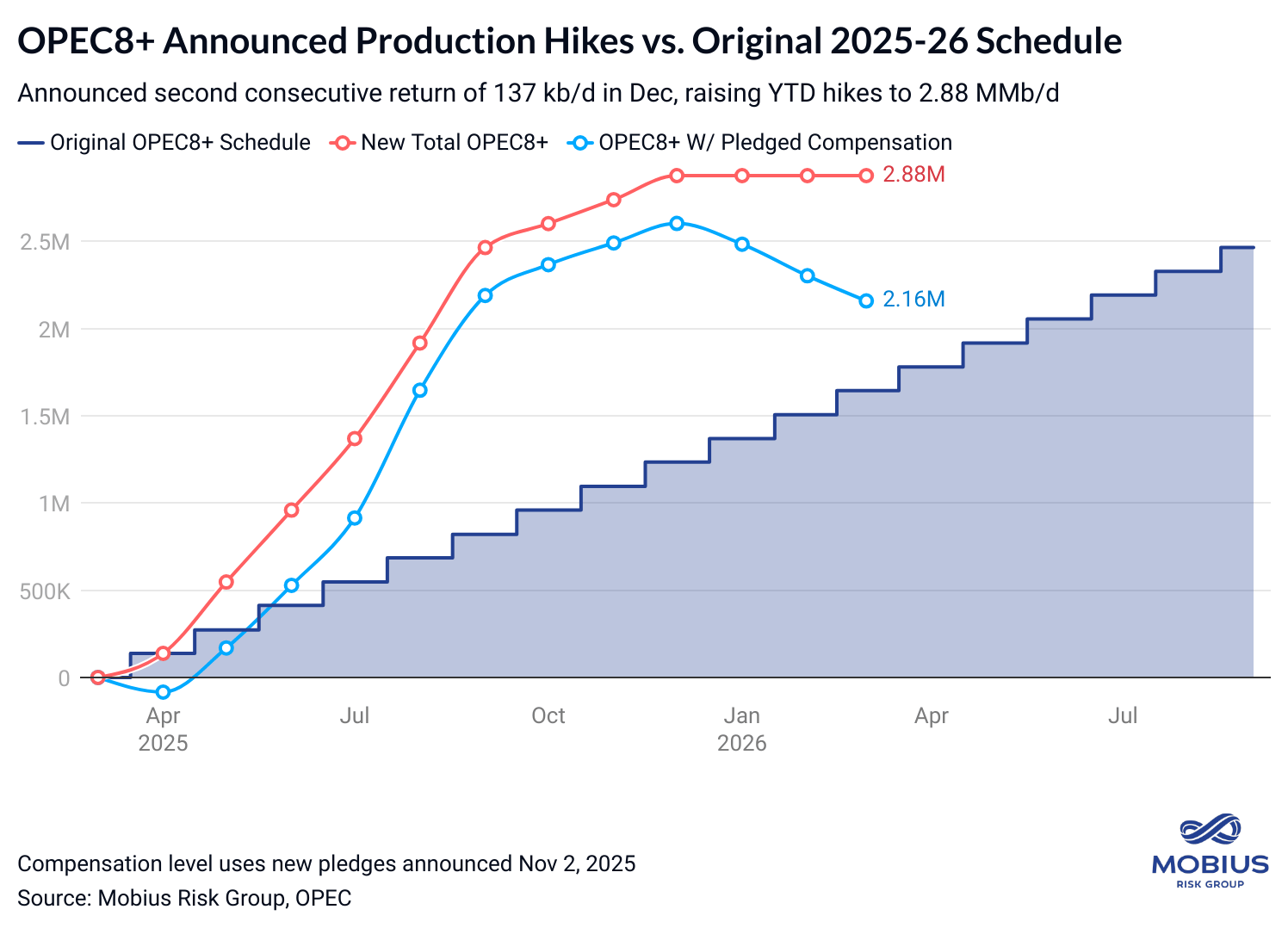

The eight members of the OPEC+ voluntary cut crew (OPEC8+) announced their ninth consecutive monthly production hike at Sunday’s virtual meeting, electing to add 137 kb/d to December production quotas and raising YTD announced hikes to 2.88 MMb/d.

However, Sunday’s announcement arrived with two notable changes from previous OPEC8+ meetings:

“Beyond December, due to seasonality, the eight countries also decided to pause the production increments in January, February, and March 2026…”

“The eight OPEC+ countries also noted that this measure will provide an opportunity for the participating countries to accelerate their compensation” in line with new compensation schedules announced on Sunday, Nov. 2.

What it means for the market:

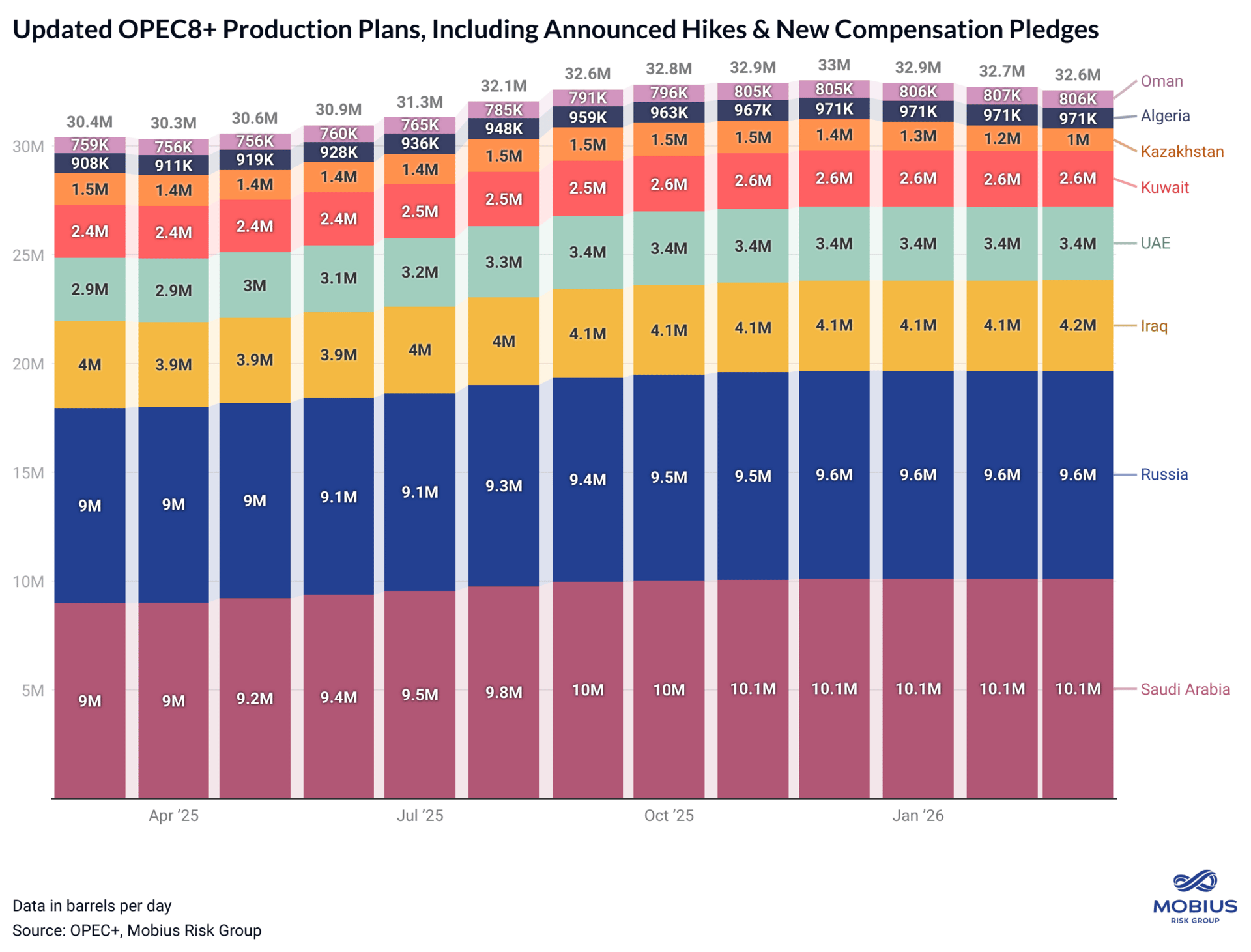

December’s unadjusted quota of 33.29 MMb/d (excl. compensation) for the eight participating countries will extend through the first quarter of 2026—subject to “evolving market conditions.”

Meanwhile, when accounting for Sunday’s new compensation schedule, combined OPEC8+ production hits an adjusted peak of 33.02 MMb/d in December before falling 119 kb/d in January, 181 kb/d in February, and 144 kb/d in March—or -444 kb/d from December to the end of 1Q26.

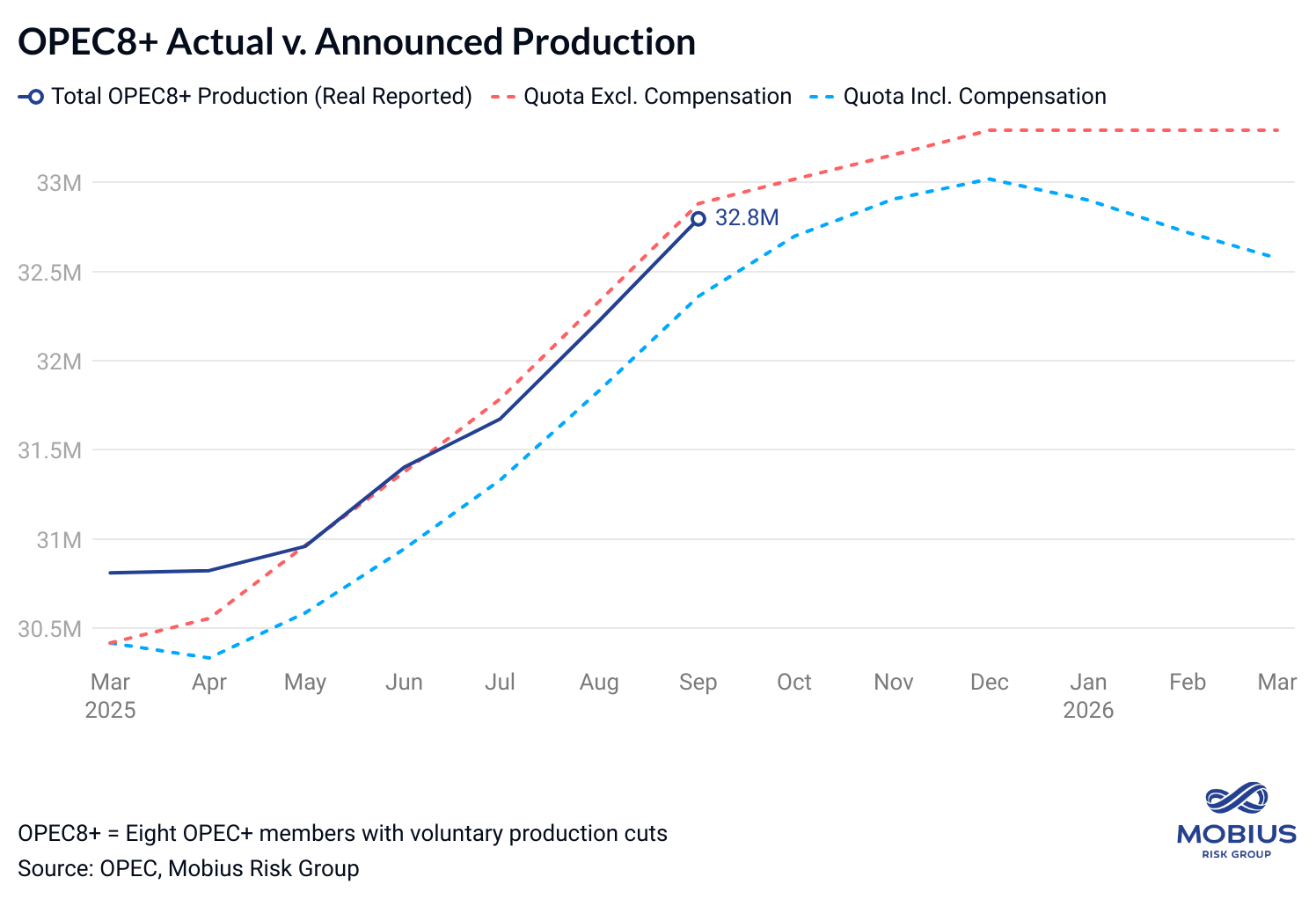

In other words, adjusted OPEC8+ production could retreat below the group’s real September 2025 output of 32.8 MMb/d by Apr 2026.

The Big “If”

While the OPEC8+’s updated compensation schedule could ease downside risks from loose balances in 1Q26, entrenched oversupply concerns are likely to require substantive evidence that the group’s overproducers are intent on reigning in output.

Thus far in 2025, commitment to OPEC8+ quotas has been nonexistent, with combined production averaging 412 kb/d above compensation-adjusted quotas from March through September.

Furthermore, alignment with pledged compensation levels worsened over the third quarter, as overproduction gained from 343 kb/d in July to 392 kb/d in August and 435 kb/d in September.

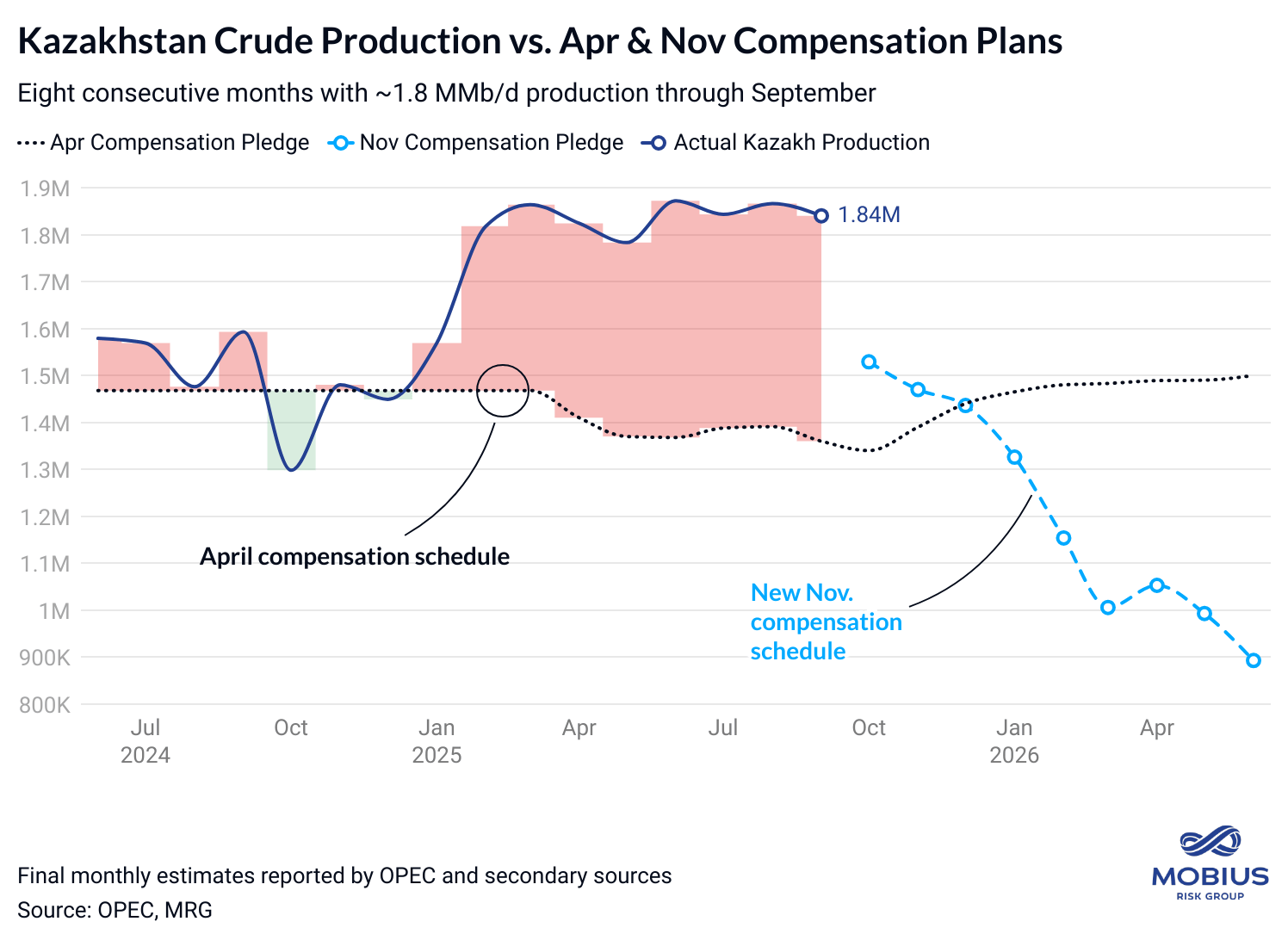

Within the group of overproducers, OPEC8+ problem child Kazakhstan has demonstrated its limited capacity to control international oil companies (IOCs) operating inside its borders, yet Kazakh cuts account for 62%-78% of Jan-Mar 2026 reductions in the OPEC8+’s latest compensation schedule.

Takeaways

Discrepancies between expected supply growth and changes in observable inventories have continued through October. Smaller OPEC8+ hikes in November and December and transient sanctions-related supply dislocations could extend this trend.

Supply disruption risks and other catalysts for short-covering rallies remain relatively abundant amidst frothy geopolitical conditions (Russia-Ukraine). A meaningful disruption in Russian supply could offset multiple months of OPEC8+ hikes and collide with near-record speculative short interest in the crude complex.

New accelerated compensation schedules will require substantive evidence that overproducers are reigning in output to ease oversupply concerns in the broader market. Absent a geopolitical disruption event and proof of compensation, the global crude market is likely to face sustained headwinds from abundant supply through 1H26.

Closer Look: Production Levels by OPEC8+ Participant

Identify Your Opportunity Set

Market conditions evolve rapidly. Reach out to the Mobius team to discuss portfolio-specific opportunities and develop tailored strategies for downstream scenarios—all backed by the industry’s most powerful analytics suite.

Please reach out to your Mobius contact or submit a request here.

See you next Sunday.

ES.

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation concerning the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is intended for Mobius clients only and is not considered promotional material.