- Mobius Market Research

- Posts

- ES #149: Schrödinger's Demand

ES #149: Schrödinger's Demand

The eight members of the OPEC+ voluntary cut crew (OPEC8+) announced their seventh consecutive monthly production hike on Sunday.

Energy Shots #149

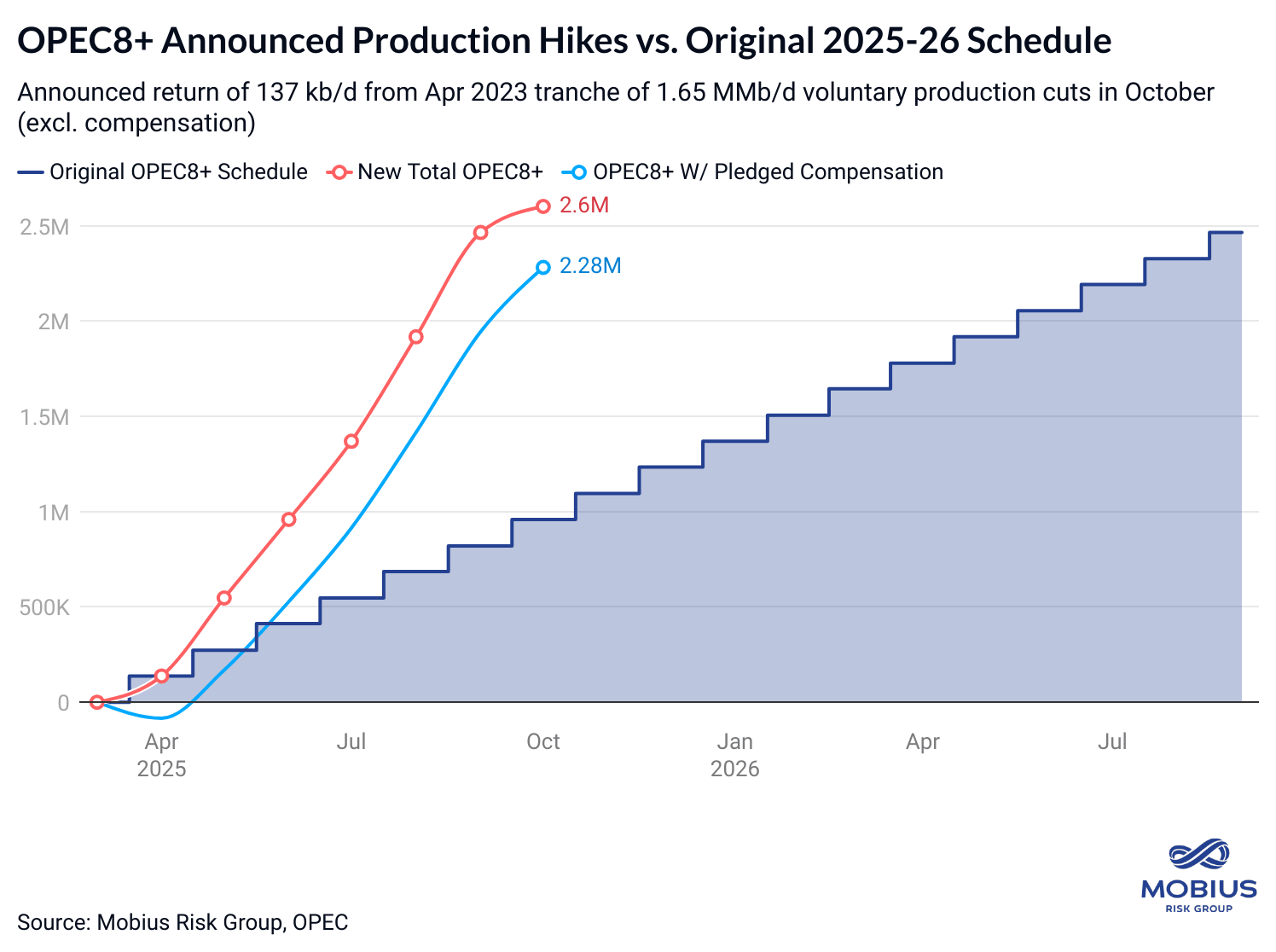

The eight members of the OPEC+ voluntary cut crew (OPEC8+) announced their seventh consecutive monthly production hike on Sunday, following August and September’s jumbo ~550 kb/d increases with a 137 kb/d bump for October to raise total YTD announcements to over 2.6 MMb/d.

Interestingly, OPEC8+ cited “current healthy market fundamentals” for its seventh straight hike this weekend, yet its YTD hikes of 2.6 MMb/d are now double its 2025 demand growth forecast of 1.3 MMb/d.

In other words, two seemingly contradictory themes are at play:

2025 demand growth of 1.3 MMb/d: According to secondary monitoring, OPEC8+ returned just shy of 1 MMb/d of output through July and is reported to have returned the lion’s share of the 548 kb/d increase slated for August. While we can offset a portion of OPEC8+ volumes with curtailments/production losses in other regions (e.g., Mexico), OPEC8’s existing barrels should have already met the group’s forecasted demand growth.

Healthy fundamentals: Global inventories supported OPEC’s “healthy fundamental” argument early this summer. However, trends in observable stocks in July and August have substantially weakened that argument. Does OPEC’s view of market conditions acknowledge abnormalities like the second-smallest Jun-Sep decline in U.S. commercial crude stocks in the last fifteen years?

Considering these discrepancies, OPEC8’s accelerated unwind schedule points to other possible motives, such as 1) regaining market share or 2) preemptive supply growth ahead of geopolitically-driven supply disruption.

Both align with the U.S. administration’s stated intention to use energy as a tool to reduce inflation and support larger/more frequent rate cuts.

For the North American producer, the takeaway is largely the same—prepare for increased supply-side competition and act quickly when geopolitical catalysts create favorable hedging opportunities.

Closer Look: YTD Supply Hikes by OPEC8 Participant

Sunday’s announcement marked a 1.64 MMb/d total YTD increase from OPEC8’s original 2025 production schedule. The breakdown by participating country is shown below. As covered here, however, the market is likely to see ongoing discrepancies between announced hikes and realized production due to entrenched overproduction from members like Kazakhstan.

Identify Your Opportunity Set

Market conditions evolve rapidly. Reach out to the Mobius team to discuss portfolio-specific opportunities and develop tailored strategies for downstream scenarios—all backed by the industry’s most powerful analytics suite.

Please reach out to your Mobius contact or submit a request here.

See you next Sunday.

ES.

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation concerning the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is intended for Mobius clients only and is not considered promotional material.