- Mobius Market Research

- Posts

- CoT: Hedge Funds Cut Crude Length As Uncertainty Increases

CoT: Hedge Funds Cut Crude Length As Uncertainty Increases

A closer look at fund managers' energy market futures and options positioning

Mobius Intel Brief:

CFTC/ICE Commitment of Traders data through March 4, 2025

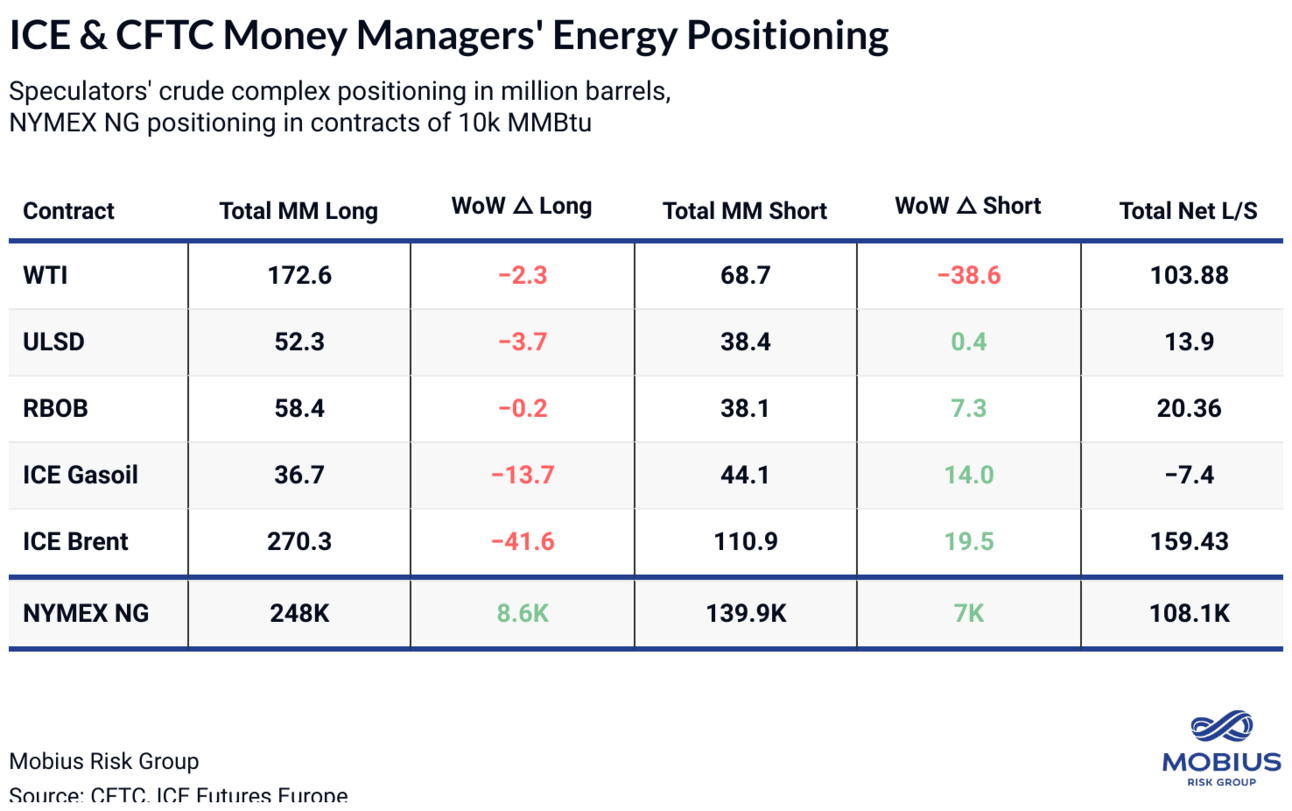

Fund managers’ net interest in NYMEX Henry Hub gained 1.6k contracts W/W to 108k total — specs’ largest net long position in NYMEX natural gas since February 2021.

Money managers’ long interest increased 8.6k contracts W/W to 248k total, offsetting 7k contracts of new short interest that raised total spec shorts to 140k total.

Fund managers’ combined net length across ICE and NYMEX crude and product benchmarks fell 64 MMb W/W to a total net of 290 MMb.

Aggregate net interest dropped 310 MMb in the past six weeks to the lowest net spec position since December 10.

Money managers net interest in ICE Brent dropped 61.12 MMb W/W—the largest weekly decrease since July of last year. Short interest in ICE Brent gained nearly 20 MMb W/W to raise specs’ total bearish interest to 111 MMb—a sixteen-week high.

Money managers’ net interest in WTI increased 36 MMb W/W as specs cut short interest by 38 MMb to offset 2 MMb of long exits.

Specs’ net interest ICE Gasoil fell 27 MMb W/W—the largest weekly decrease since June 2019 and enough to send funds’ back to a net short position for the first week since December 10.

Money managers’ net length in NYMEX ULSD and RBOB fell 4.1 and 7.5 MMb W/W, respectively.

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation with respect to the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is exclusively intended for Mobius clients and is not considered promotional material.