- Mobius Market Research

- Posts

- CoT: Demand Uncertainty Permeates

CoT: Demand Uncertainty Permeates

A closer look at the latest speculator positioning

Mobius Intel Brief:

Crude Complex Highlights:

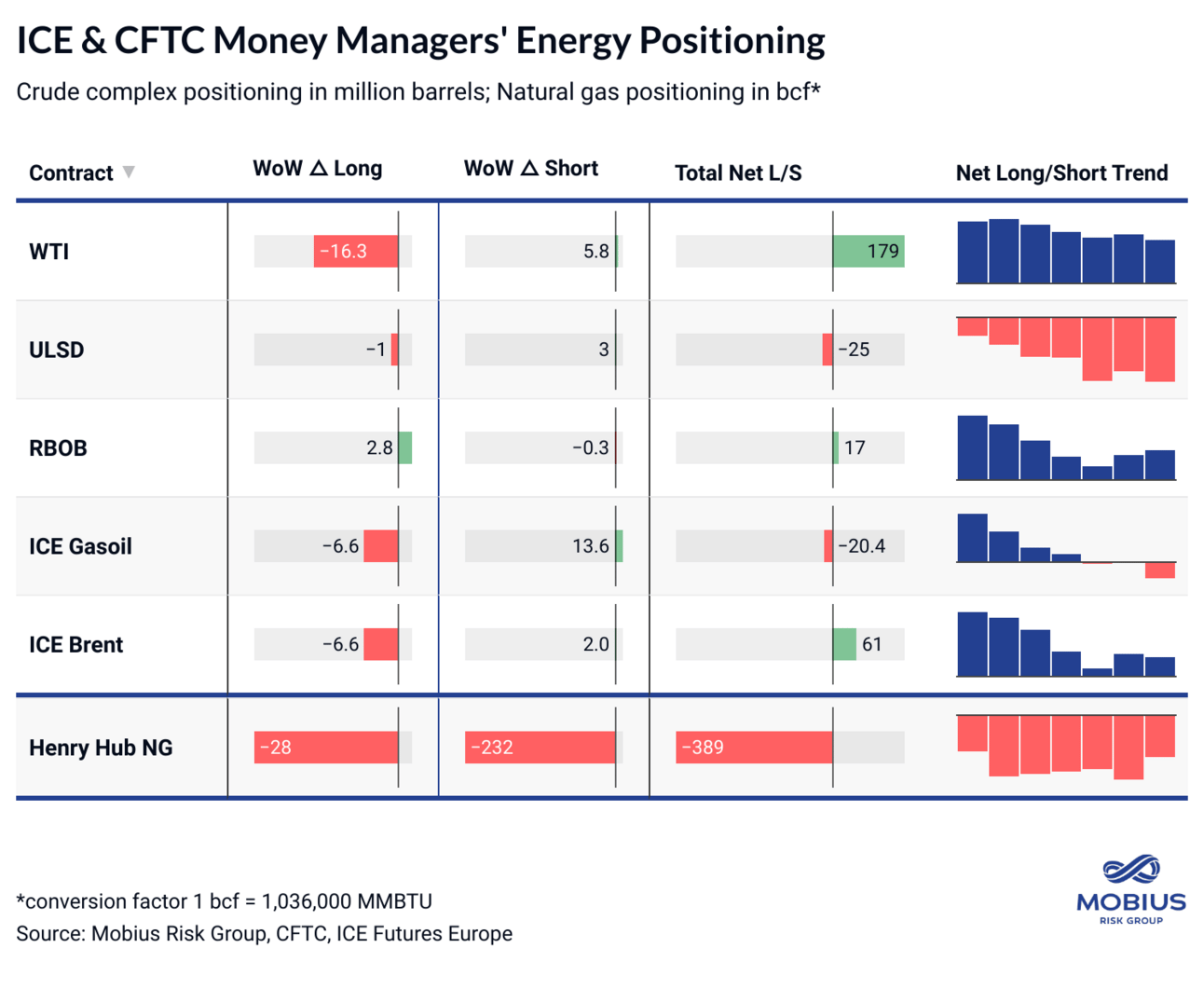

Fund managers’ net futures and options holdings across the ICE/NYMEX crude complex shed 51.9 MMb to 211.7 MMb in the seven days ending August 20, erasing roughly 75% of the long interest added in the week ending August 13. Net spec interest in ICE/NYMEX crude and products remains historically low, falling to the 10-YR 1st percentile in the latest CFTC and ICE commitments of traders data. Elevated short positions amidst diminished long interest remain an upside price risk to monitor. After directionally contrasting ICE spec holdings for several weeks, fund managers’ long interest in NYMEX WTI fell considerably to the bottom decile of its 10-YR historical range, inviting modest upside price potential (caveats below).

Natural Gas Highlights:

Speculators removed significant short interest from their net Henry Hub futures and options holdings in the seven days ending August 20, offsetting a slight decline in fund managers’ long bets. Net length increased by the equivalent of 204 bcf to -388.8 bcf — the 10-YR 36th percentile.