- Mobius Market Research

- Posts

- Brief: Shutting Off Russian Pipeline Gas

Brief: Shutting Off Russian Pipeline Gas

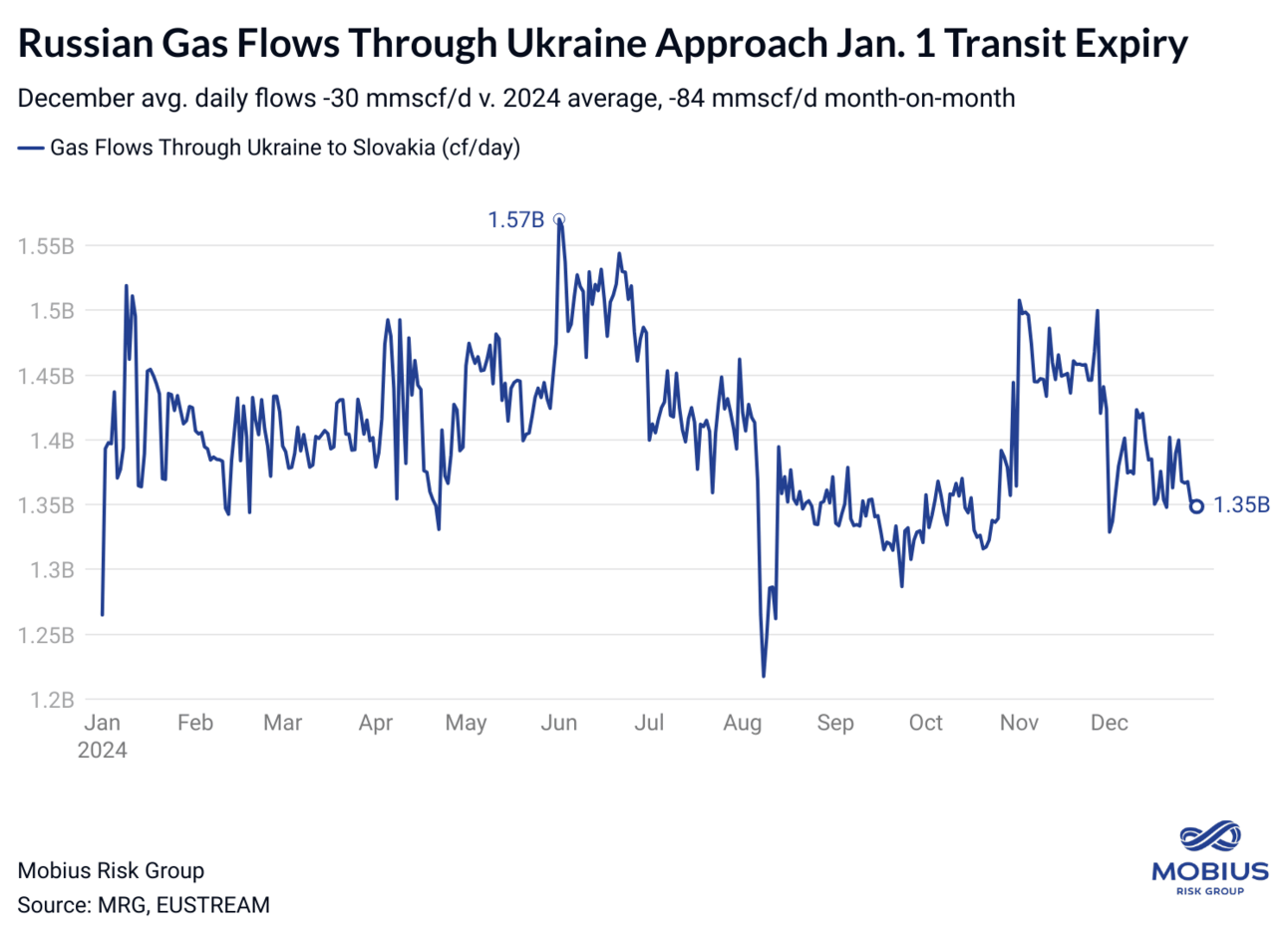

Russian gas flows through Ukraine are due to halt on Jan 1 with the expiration of the Gazprom-Ukraine transit agreement.

Mobius Intel Brief:

Approximately 1.35 Bcf/d of Russian pipeline gas supplies to Europe are due to halt overnight with the Jan 1 expiration of the five-year Gazprom-Ukraine gas transit agreement.

Key Intel

The long-anticipated expiration of the Gazprom-Ukraine agreement will expand Europe’s dependence on Norwegian pipeline gas and LNG imports with three months remaining in winter ‘24-’25 and EU gas storage at approximately 72% capacity.

Live pipeline data shows the lion’s share of the 1.35 Bcf/d of gas flowing through Ukraine to Slovakia are re-exported to Austria (~0.76 Bcf/d in Dec) and the Czech Republic (~0.44 Bcf/d in Dec).

According to Austrian government data, Russian gas supplies through Ukraine/Slovakia still account for nearly all Austrian gas imports as of this week. However, Austrian gas inventories are approximately 79% full, indicating minimal immediate impact from the expiring agreement.

Germany’s Dec 20 decision to exempt foreign buyers from its domestic gas levy beginning Jan 1 will enable Austria, the Czech Republic, and Slovakia to secure alternative supplies via Western Europe.

Takeaways

The overnight expiration of the Gazprom-Ukraine transit agreement will cut a modest (5-8%) share of Europe’s total gas supplies.

Austria, Slovakia, and the Czech Republic will be directly affected as buyers are forced to secure supplies from the West. Western European markets (Germany) could face meaningful indirect consequences via elevated exposure to Norwegian pipeline gas and LNG imports from the U.S. and the Mideast.

Despite consistent messaging that Ukraine would not extend the transit agreement beyond Jan 1, Europe’s supply fears helped Feb ‘25 Dutch TTF return to late-Nov/early-Dec highs of ~$14.80/MMBTU this week after a brief trip below $13/MMBTU in the middle of the month.

Aggregate EU gas inventories have depleted by approximately 842 Bcf since the Oct 1 start of withdrawal season — the largest seasonal depletion since 2016 despite comparatively warm weather this year. EU and regional gas storage will be closely watched as the expiration of Ukraine’s transit agreement marks the start of Europe’s first winter with nominal volumes of Russian pipeline gas.

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation with respect to the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is exclusively intended for Mobius clients and is not considered promotional material.