- Mobius Market Research

- Posts

- Brief: Rate Cut Bets Gain Despite Sticky Inflation Data

Brief: Rate Cut Bets Gain Despite Sticky Inflation Data

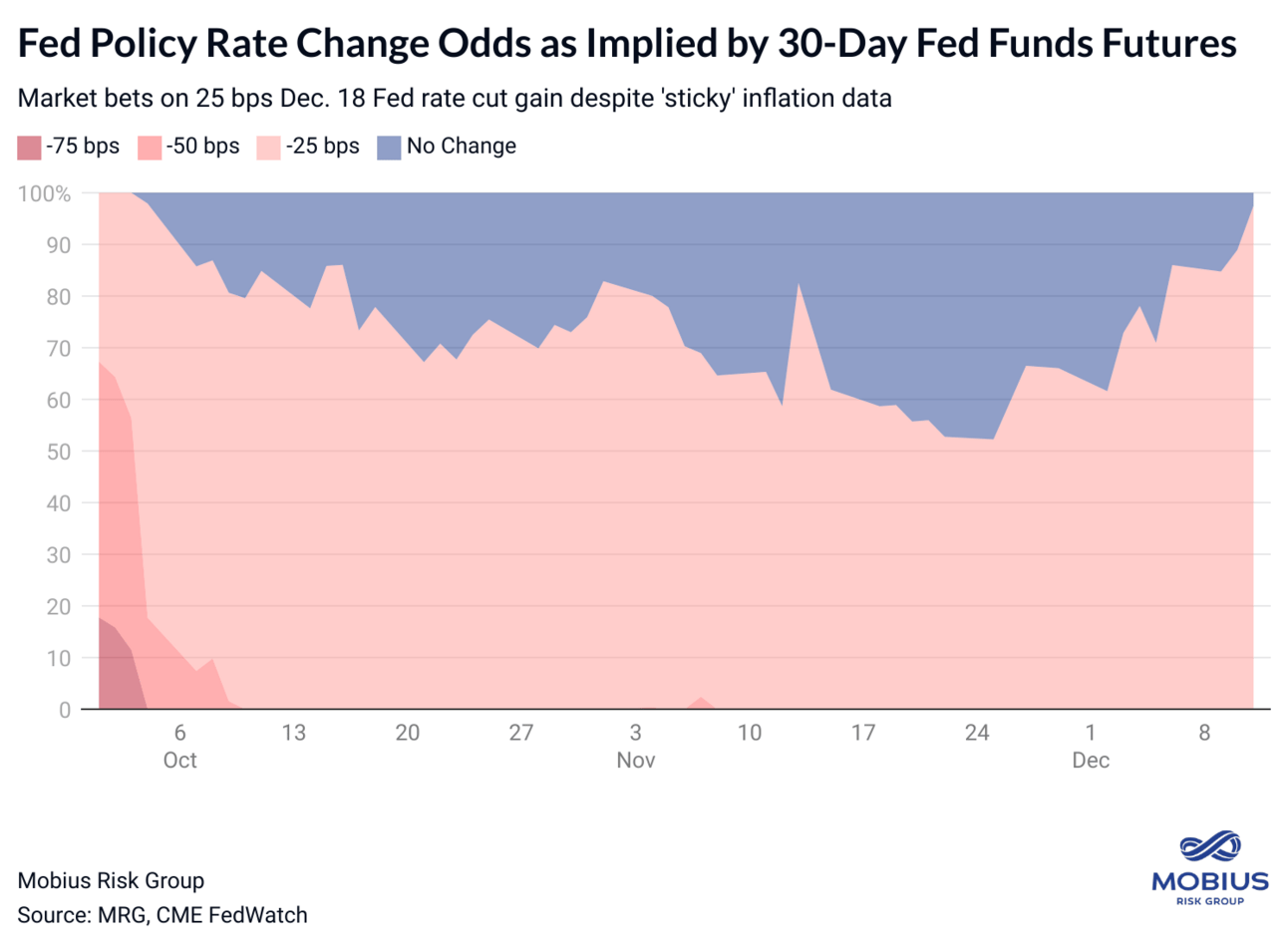

Consecutive months of 'sticky' consumer and producer price growth has not dissuaded market participants' bets on a 25 bps rate cut at the Fed's Dec. 18 meeting.

Mobius Intel Brief:

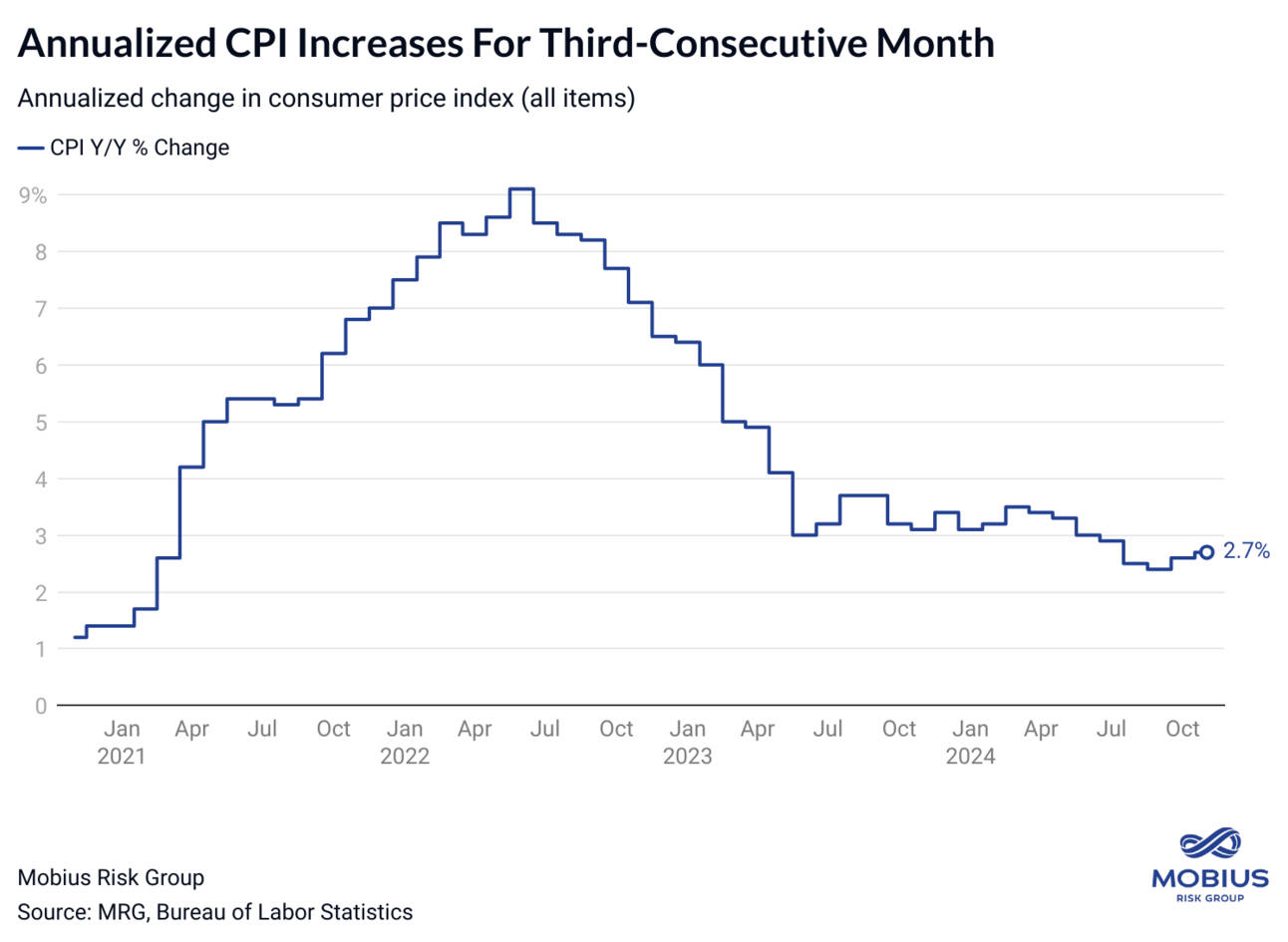

November’s Consumer and Producer Price Indices (CPI/PPI) beat median economist expectations, with producers’ annualized input price growth accelerating to its highest since February 2023 and ‘core’ CPI notching its third-consecutive month at +3.3% Y/Y.

Key Intel: Concerns about cooling US labor market conditions are reinforcing market participants’ bets on another 25 bps rate cut at the Fed’s Dec. 18 meeting despite increasing or ‘sticky’ inflation data. Fed policy rate change odds implied by 30-day fed funds futures show participants currently assign a >97% chance of a 25 bps cut next week. Meanwhile, elevated consumer and producer price growth for consecutive months suggests the Fed’s rate cut frequency could run into hurdles in early 2025.

US supply chain costs retain upside skew in Q1 2025 on favorable odds for an extended International Longshoremen’s Association (ILA) strike at major East/Gulf Coast ports in mid-January.

ILA strike concerns are amplified by importers’ elevated tariff uncertainty when President-elect Trump takes office in January.

Labor market conditions have shown mixed signals in recent months but generally retain downside skew after consistent material revisions to government jobs data.

Muddy inflation/labor market data could lead to slower or smaller interest rate cuts — downstream effects of which are likely most problematic for non-US economies teetering on recession already (the EU, Canada) and smaller US businesses’ borrowing costs.

China’s easing monetary policy stance, Q3/Q4 2024 stimulus measures, and reported efforts to weaken the renminbi in 2025 could offset some demand headwinds from a strong dollar/Trump-related tariffs. The EU’s economic outlook shows signs of deterioration that will likely accelerate and further pull on the bloc’s demand without easing US interest rates.

A closer look at November US inflation trends:

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation with respect to the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is exclusively intended for Mobius clients and is not considered promotional material.