- Mobius Market Research

- Posts

- Brief: Germany's 83% D/D Drop in Wind Output

Brief: Germany's 83% D/D Drop in Wind Output

A second episode of 'Dunkelflaute' weather conditions heads for Germany, cutting wind and solar output to seasonal lows

Mobius Intel Brief:

German grid operators are preparing for tight power supplies as day-ahead forecasts show wind generation dropping by as much as 83% overnight with the arrival of NW Europe’s second bout of dark and calm ‘Dunkelflaute’ conditions.

Germany’s onshore wind fleet is expected to produce an average of just 2.3 GW on December 11 from an average of nearly 14 GW today. December 10’s early-morning peak wind output of 24.5 GW is forecast to drop to a minimum of 1.3 GW on Dec. 11.

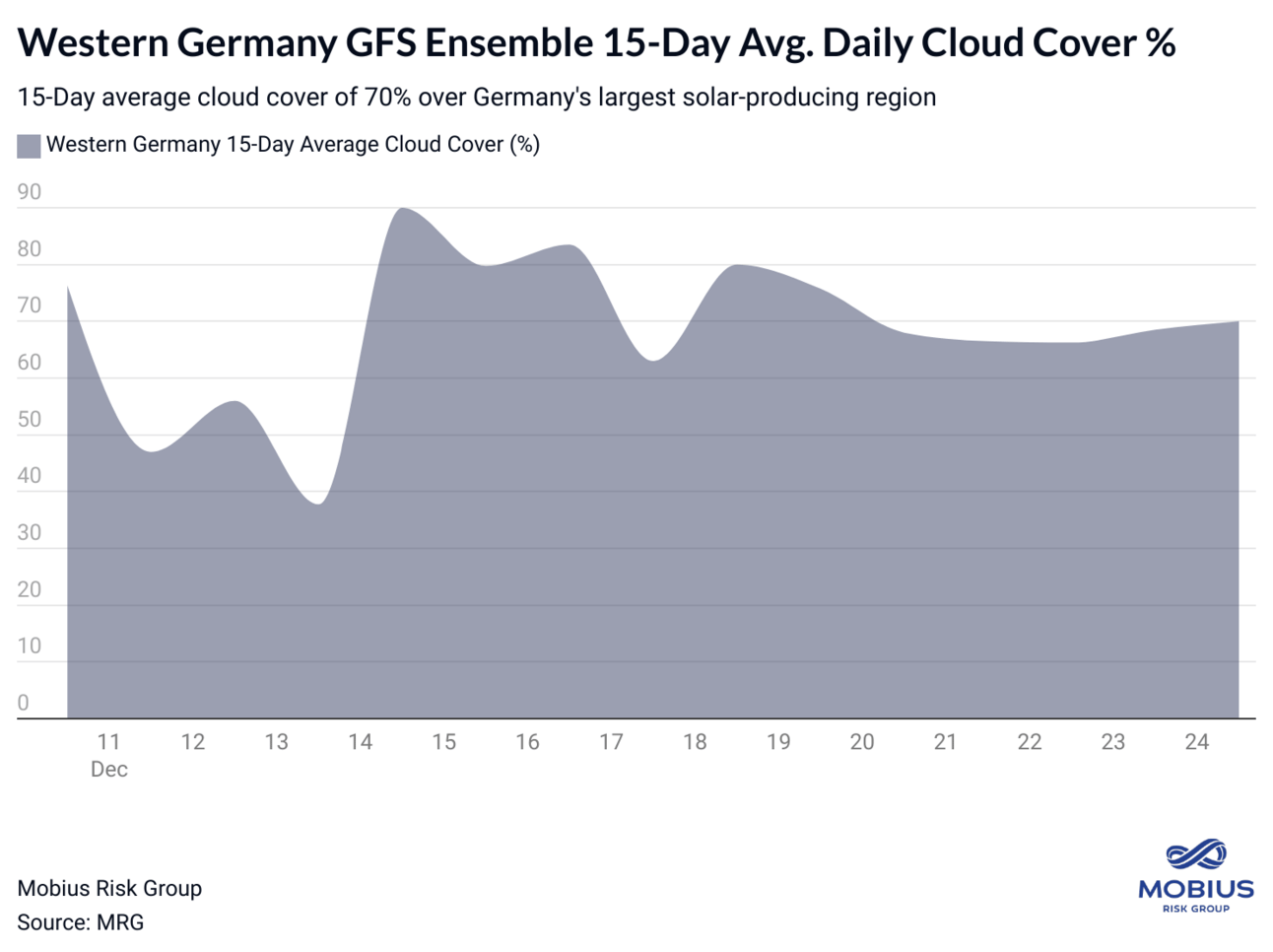

Pressure on Germany’s wind fleet coincides with two weeks of ~70% cloud coverage over western and central regions that house the majority of Germany’s solar fields.

Meanwhile, dark and calm conditions are joined by several days of colder-than-normal temperatures that will elevate Germany’s power demand for heating.

Average daily temps are forecast to drop between 4-8 degrees below seasonal norms over the next several days.

Expectations for tight power supplies passed through to today’s day-ahead auction price on EPEX SPOT, which gained over €445/MWh for peak demand hours on December 11 — the highest since dark and calm weather hovered over Germany in early November.

As occurred during early November’s ‘dunkelflaute’, low renewable output has concentrated demand for reliable thermal generation from lignite, hard coal, and natural gas — adding to Europe’s near-term supply concerns for the bloc’s first non-mild winter without Russian pipeline gas.

Jan ‘25 TTF has remained above $14/MMBTU since mid-Nov., when EU inventories began their fastest seasonal depletion since 2016 despite comparatively warm temperatures in 2024 vs. eight years ago.

The following heatmaps provide a clearer look at Germany’s load, variable renewable output, and concentrated demand for gas-fired generation since the start of October.

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation with respect to the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is exclusively intended for Mobius clients and is not considered promotional material.