- Mobius Market Research

- Posts

- Brief: Five Years of Guyanese Crude Production

Brief: Five Years of Guyanese Crude Production

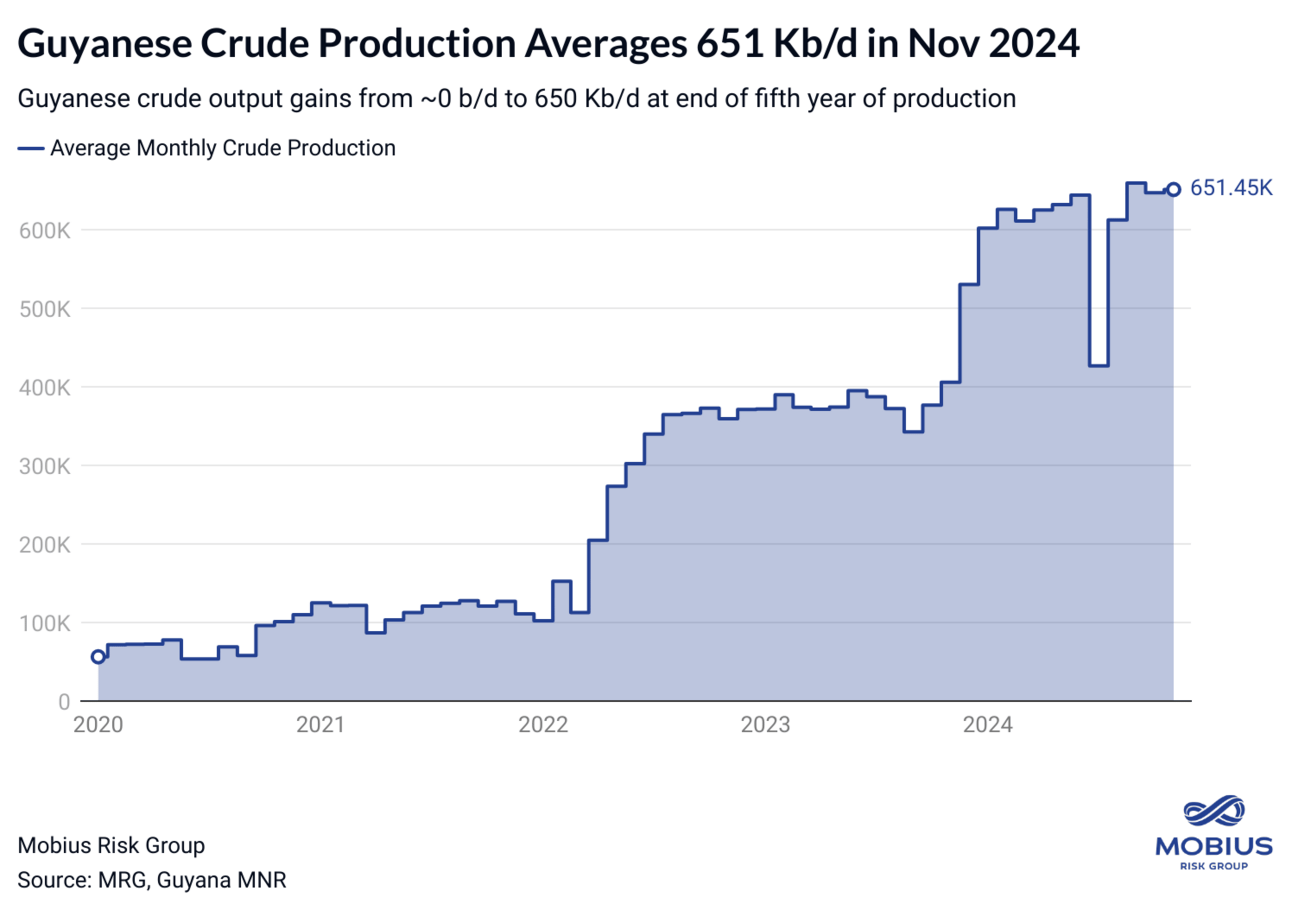

Guyana's latest production data shows output reached its second-highest daily average on record in November, five years after the Exxon-led consortium began producing.

Please note: Our Intel Briefs will pause for the remainder of this week and will return Monday, December 30 with updates to CFTC/ICE positioning data. All of us at Mobius wish you and your loved ones a joyful and restful holiday week!

Mobius Intel Brief:

Last Thursday marked the Exxon-led consortium’s fifth full year of production in Guyana’s offshore Stabroek block. Data released this week shows the group produced an average of 651 Kb/d in November — the second-highest monthly average on record and just shy of Exxon’s current authorized production capacity of 665 Kb/d.

The group’s 2024 average output gained to 612 Kb/d with November’s data, a 221.6 Kb/d increase from 2023’s average.

Guyana’s newest Prosperity FPSO finished its first year in operation with a daily average of 250 Kb/d of med-heavy Payara Gold output in November, making it the Stabroek block’s most productive vessel.

Imminent upgrades to the Liza Unity FPSO are expected to raise the vessel’s output to 270 Kb/d, bringing production to a total of 675 Kb/d for Guyana’s three existing projects.

Guyana’s fourth FPSO (One Guyana) for the Yellowtail project is set to depart for the country in Q1 2025, adding 250 Kb/d of production capacity by the end of the year.

According to the Exxon-led group, output is on track to double from current levels by year-end 2027 with the sequential additions of the Yellowtail (250 Kb/d), Uaru (250 Kb/d), and Whiptail (250 Kb/d) projects.

With a 250 Kb/d increase in Guyanese production next year, Guyana would represent less than 1% of global supply but account for approximately 20% of 2025’s estimated demand growth according to the average of the DOE and OPEC’s forecasts. As highlighted by Mobius’ Zane Curry in recent Daily Market Updates, incremental non-OPEC supply growth from Guyana and post-TMX Canada could substantially reduce the market’s appetite for more OPEC or US contributions in 2025. Readers can explore this DMU for more detailed commentary on these two countries.

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation with respect to the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is exclusively intended for Mobius clients and is not considered promotional material.