- Mobius Market Research

- Posts

- Brief: Crude's Narrow Inventory Buffer

Brief: Crude's Narrow Inventory Buffer

OPEC's delayed production returns, geopolitical conflict, and Iran/Venezuela sanction threats vs. limited capacity for global crude inventories to absorb sudden shocks.

Mobius Intel Brief:

OPEC followed last week’s decision to prolong 2.2 MMb/d of voluntary production cuts through Q1 2025 with its fifth cut to its 2024 global oil demand growth forecast today to +1.61 MMb/d Y/Y vs. +2.25 MMb/d in its July forecast.

OPEC’s consecutive decisions have ensured market participants are focused on near-term economic uncertainty and its effects on petroleum consumption in growth centers like China and India.

Meanwhile, this myopic focus on underwhelming demand has ignored the effects of prolonged OPEC production cuts on global crude inventories, which have steadily dropped to historically low levels in early December.

Depleted global crude inventories face potential supply- and demand-side catalysts that place more weight on OPEC’s (Saudi Arabia’s) production elasticity.

Supply side watch: expanding geopolitical tensions across the Middle East and the second Trump administration’s Iran/Venezuela sanctions policies.

Demand side watch: delayed effects of Sep/Oct 2024 stimulus and the CCP’s easing monetary policy stance on China’s 2025 growth.

A closer look at crude inventory trends:

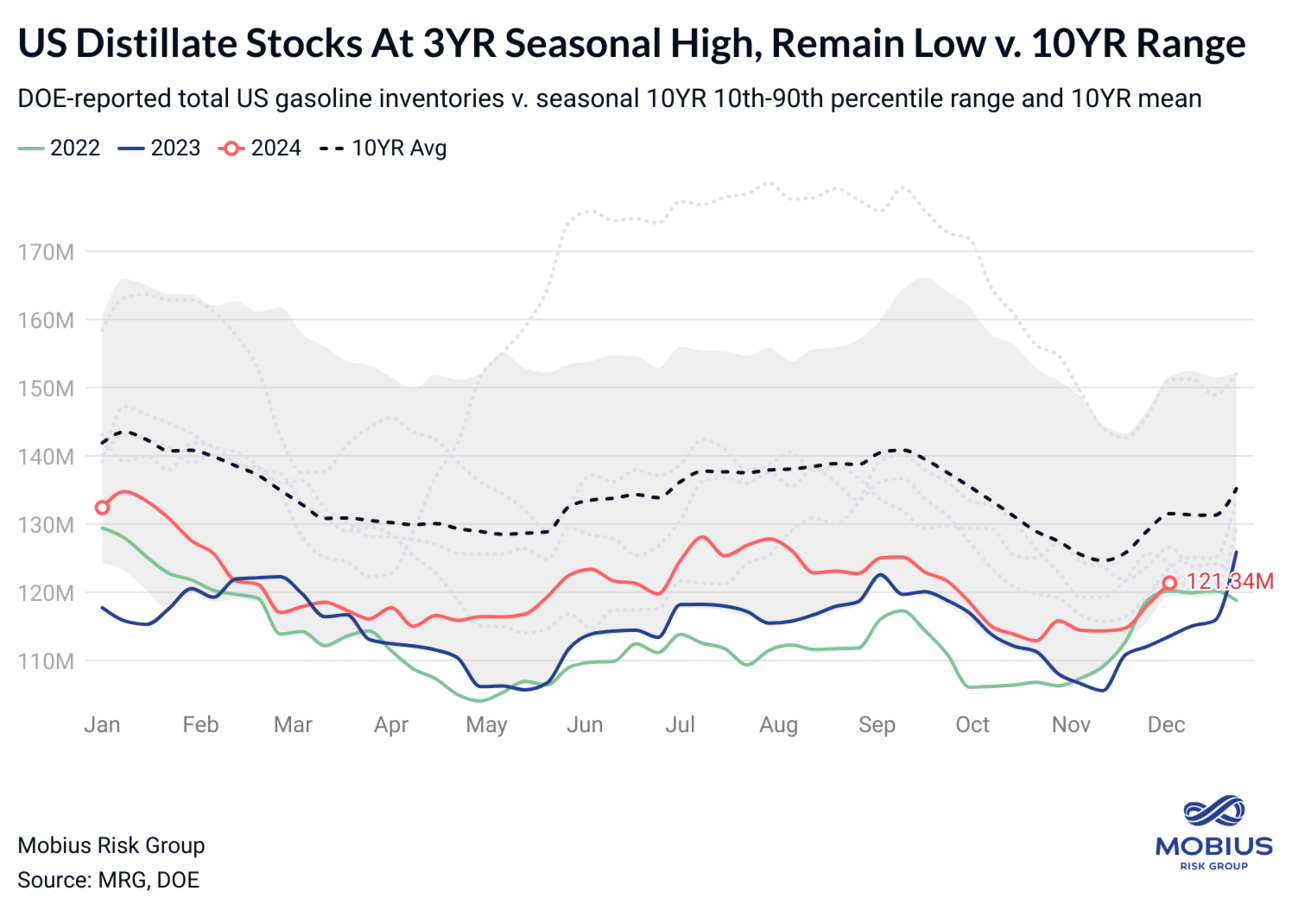

A closer look at US product inventory trends:

This commentary contains our views and opinions and is based on information from sources we believe are reliable. This commentary is for informational purposes, should not be considered investment advice, and is not intended as an offer or solicitation with respect to the purchase and sale of commodity interests or to serve as the basis for one to decide to execute derivatives or other transactions. This commentary is exclusively intended for Mobius clients and is not considered promotional material.